Decentralized Finance, often abbreviated as DeFi, is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments. Instead, it utilizes smart contracts on blockchains, the most common being Ethereum.

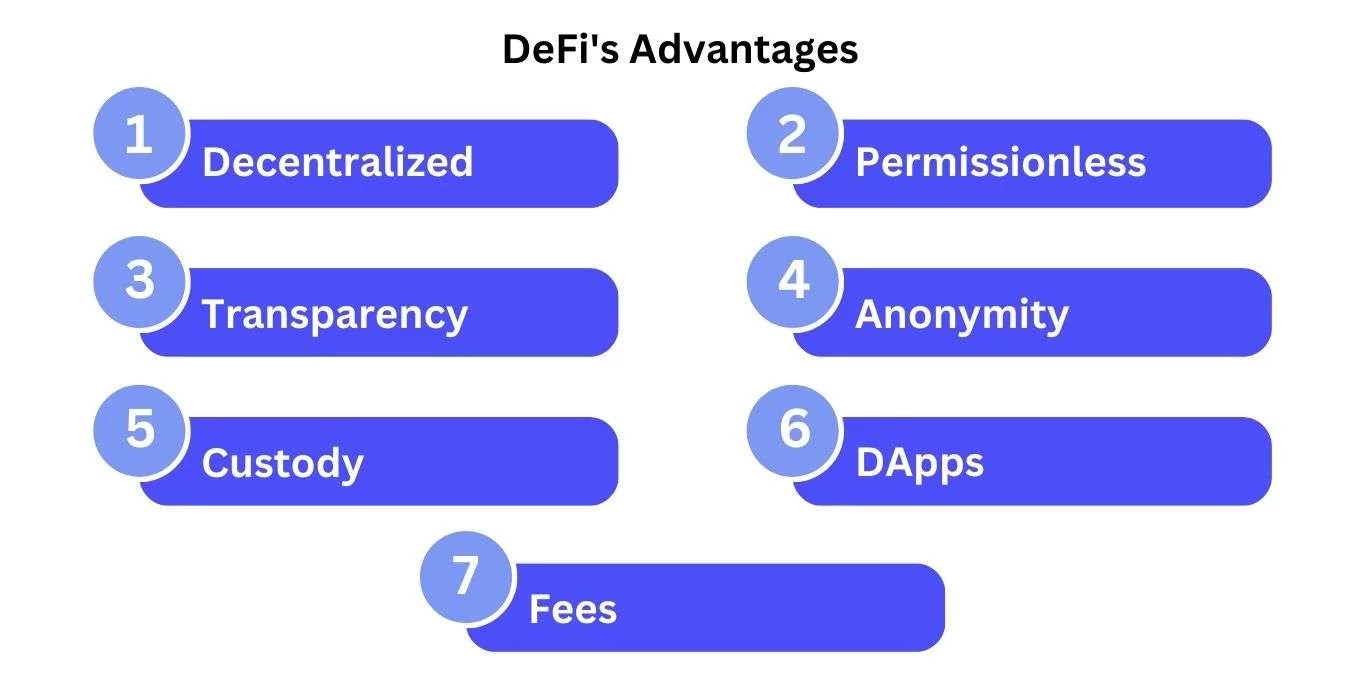

Advantages of DeFi

- Accessibility: DeFi platforms are open to anyone with an internet connection and a digital wallet. This means that people in unbanked or underbanked regions can access financial services that were previously unavailable to them.

- Transparency: All transactions on the blockchain are public and can be viewed by anyone. This transparency reduces the risk of fraud and manipulation.

- Control: With DeFi, you are in control of your money. Unlike traditional banking, your funds are not held by a centralized entity. This gives you complete control over your assets.

- Innovation: DeFi is a rapidly evolving field with new financial products and services being developed regularly. This innovation brings about new opportunities for investors and users alike.

Disadvantages of DeFi

- Risk: DeFi is a relatively new and unregulated market. This means that there is a higher risk associated with investing in DeFi projects. The technology is also complex and may be difficult for newcomers to understand.

- Security: While the blockchain is secure, smart contracts can have vulnerabilities that can be exploited by hackers. Additionally, if you lose access to your digital wallet, you lose access to your funds.

- Scalability: Currently, the Ethereum network, where most DeFi projects reside, can only process a limited number of transactions per second. This can lead to high transaction fees during periods of high network activity.

- Lack of Recourse: If something goes wrong with a DeFi transaction, there is no central authority to turn to for help. This is different from traditional banking where disputes can be resolved by the bank or a regulatory body.

Conclusion

DeFi offers many advantages over traditional finance, including increased accessibility, transparency, and control. However, it also comes with its own set of challenges, such as risk, security, scalability, and lack of recourse. As we move into 2024, it’s important for newcomers to the crypto world to understand both the opportunities and the risks that DeFi presents.

Always do your own research and consider seeking advice from a financial advisor before investing in DeFi projects. Stay safe, and happy investing!