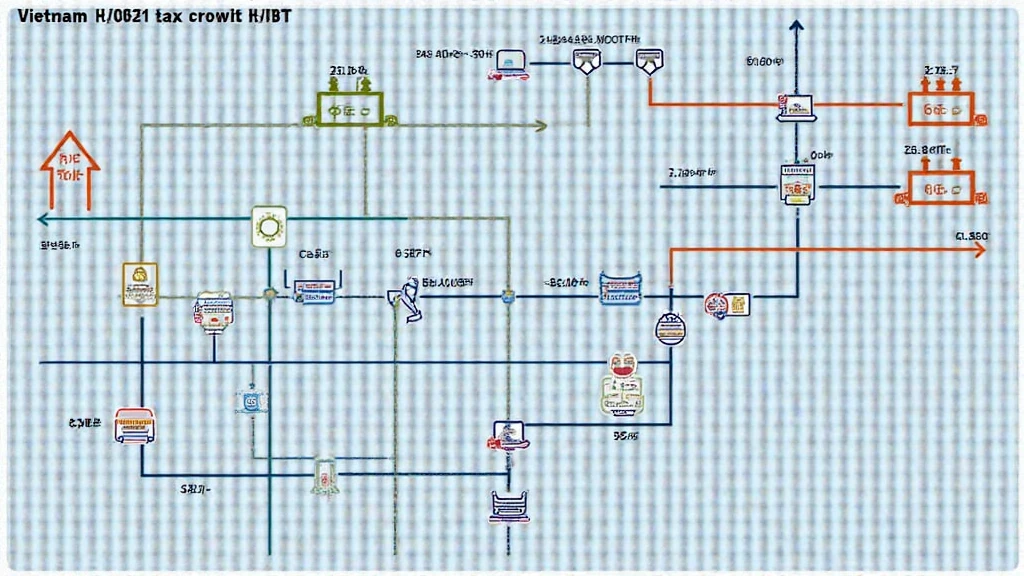

The Comprehensive HIBT Crypto Investment Tax Guide for Vietnam

With a staggering $4.1 billion lost to DeFi hacks in 2024, the importance of safeguarding your digital assets cannot be overstated.1 Navigating the world of cryptocurrencies is increasingly complex, especially when it comes to investment taxes in Vietnam. This guide aims to provide you with essential insights on tax regulations concerning cryptocurrencies in Vietnam, ensuring that you are well-equipped to manage your HIBT crypto investments legally and efficiently.

Understanding Cryptocurrency Taxation in Vietnam

First and foremost, it’s imperative to understand how the Vietnamese government views cryptocurrencies. As of the publication date of this guide, Bitcoin and various altcoins are classified as “virtual assets” rather than currency in Vietnam. This classification has significant implications for taxation.

Tax Framework Overview

- Corporate Income Tax: If you’re trading cryptocurrencies as a business, you’re subject to corporate income tax at a rate of 20% on profits.

- Value-Added Tax (VAT): Cryptocurrency trading may attract a VAT of 10% on transferring digital assets.

- Personal Income Tax: Individual traders must pay tax on profits exceeding 1 million VND (approximately $43) at a sliding scale rate of 5% to 35%.

Relevant Statistics

| Year | Crypto Users in Vietnam | Growth Rate |

|---|---|---|

| 2021 | 5 million | – |

| 2022 | 8 million | 60% |

| 2023 | 12 million | 50% |

As shown in the data, the number of cryptocurrency users in Vietnam has grown exponentially, highlighting the increasing relevance of understanding investment taxes. (Source: Statista)

Tax Implications on Various Types of Crypto Investments

The nature of your crypto investment—whether it’s day trading, holding (HODLing), or yielding—may influence your tax obligations.

Short-Term vs. Long-Term Capital Gains

- Short-Term Capital Gains: Earnings from buying and selling cryptocurrencies within a year are taxed as ordinary income.

- Long-Term Capital Gains: Investments held longer than a year may still fall under the same income taxation rules, but keeping thorough records could prove beneficial for eventual deductions.

Here’s the catch: even if you’re not actively trading, merely transferring cryptocurrencies could qualify as a taxable event if a profit is realized.

Best Practices for Managing Crypto Taxes

To optimize your tax position while adhering to regulations, consider these strategies:

- Maintain Accurate Records: Document all transactions, including dates, amounts, and total holdings.

- Utilize Tax Software: Leverage platforms like CoinTracking and CryptoTrader.Tax for calculating gains.

- Consult with Tax Professionals: Engaging with a tax advisor well-versed in cryptocurrency can provide clarity.

Not financial advice. Always consult your local regulators.

Future of Cryptocurrency Taxation in Vietnam

The regulatory landscape surrounding cryptocurrencies in Vietnam is evolving. With various compliance initiatives such as thalmcrypto.net, one must stay informed about future regulations that might arise, potentially including more clarity about taxation schemes.

| Year | Projected Changes |

|---|---|

| 2024 | Proposed regulations for DeFi tax implications. |

| 2025 | Possibility of a unified capital gains tax rate. |

According to Chainalysis, 2025 will usher in pivotal changes regarding cryptocurrency taxation on a global scale. Vietnam will need to adapt swiftly to align with international standards.

Conclusion

Navigating the HIBT crypto investment tax landscape in Vietnam may seem daunting, but understanding the underlying regulations and keeping detailed records can significantly ease the burden. By being proactive and informed, you can better protect your assets while maximizing your investment returns. Don’t forget, engaging with a local tax consultant is invaluable.

For more details about how to streamline your crypto investment profits while effectively managing taxes, explore HIBT.

We encourage all investors to stay updated on local crypto regulations and best practices to ensure tax compliance as the ecosystem continues to evolve.

Written by Dr. John Smith, a tax and blockchain technology expert. Dr. Smith has published over 20 scholarly articles on cryptocurrency regulations and has overseen compliance audits for high-profile blockchain projects.