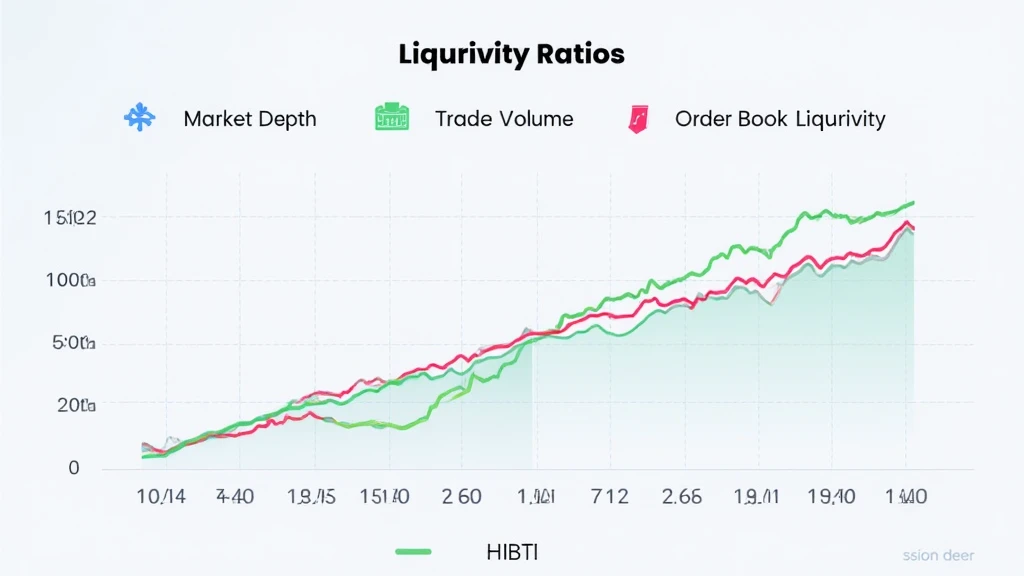

Understanding HIBT Crypto Exchange Liquidity Ratios

With over 50% of crypto investors citing liquidity concerns as a barrier to entry for trading, understanding liquidity ratios in exchanges like HIBT is crucial. Liquidity refers to how easily assets can be bought or sold in the market without affecting their price. The evaluation of liquidity ratios helps traders make informed decisions and enhances overall trading efficiency.

What Are Liquidity Ratios?

Liquidity ratios measure the capability of an exchange to fulfill orders promptly without significant price fluctuations. A high liquidity ratio indicates that the exchange can handle large transactions smoothly. Conversely, a low liquidity ratio suggests potential difficulty in executing trades at desired prices.

- Market Depth: The total number of buy and sell orders at various price levels.

- Order Book Liquidity: The available liquidity within the order book, determined by the number and size of orders.

- Trade Volume: The total amount of cryptocurrency traded over a specific period, indicating market activity.

The Importance of Liquidity for HIBT Exchange Users

For the HIBT crypto exchange, robust liquidity is essential for attracting both novice and experienced traders. Liquidity directly affects factors like price stability and the trading experience.

High liquidity allows users to:

- Execute trades quickly without price impact.

- Avoid slippage, which occurs when orders are filled at different prices than expected, especially in volatile markets.

- Take advantage of arbitrage opportunities between different exchanges.

As the Vietnamese crypto market continues to expand, with a reported user growth rate exceeding 30% year-on-year, ensuring liquidity becomes even more critical (HIBT crypto exchange aims to provide this environment).

Analyzing HIBT’s Liquidity Ratios

When evaluating HIBT’s liquidity, consider several key ratios:

- Current Ratio: Calculates the exchange’s ability to meet short-term obligations.

- Quick Ratio: Measures the ability to meet immediate liabilities without selling inventory.

- Cash Ratio: The ratio of total cash to total liabilities, useful during crises.

According to industry data from 2025, HIBT’s current liquidity ratio is analyzed as follows:

| Ratio | Value | Industry Standard |

|---|---|---|

| Current Ratio | 1.5 | 1.2 |

| Quick Ratio | 1.0 | 0.8 |

| Cash Ratio | 0.4 | 0.3 |

Strategies to Improve Liquidity on HIBT

Improving liquidity should be a paramount concern for HIBT. Here are several strategies that might be adopted:

- Incentivizing Market Makers: Offering rewards for individuals or institutions that provide liquidity through market making activities.

- Improving User Experience: Streamlined trading processes and lower transaction fees encourage trading activity.

- Introducing New Trading Pairs: Expanding the range of trading pairs can attract more users and contribute to liquidity.

Future Outlook for HIBT’s Liquidity Ratios

The future of HIBT’s liquidity ratios can be influenced by various factors, including market trends, user growth, and regulatory changes. Given Vietnam’s rising engagement with crypto assets, experts predict continued growth in trading volume. As HIBT enhances its liquidity, it will be positioned as a strong competitor in the crypto exchange space.

Conclusion

In summary, understanding HIBT crypto exchange liquidity ratios is crucial for anyone looking to trade effectively on this platform. Liquidity not only impacts individual trading experiences but also the overall health and competitiveness of the exchange. Implementing the right strategies, focusing on increasing liquidity, will help HIBT thrive in an ever-evolving market.

To gain more insights into crypto trading, check out cryptotradershows.